Stablecoin yield: Who gets paid when digital cash earns interest?

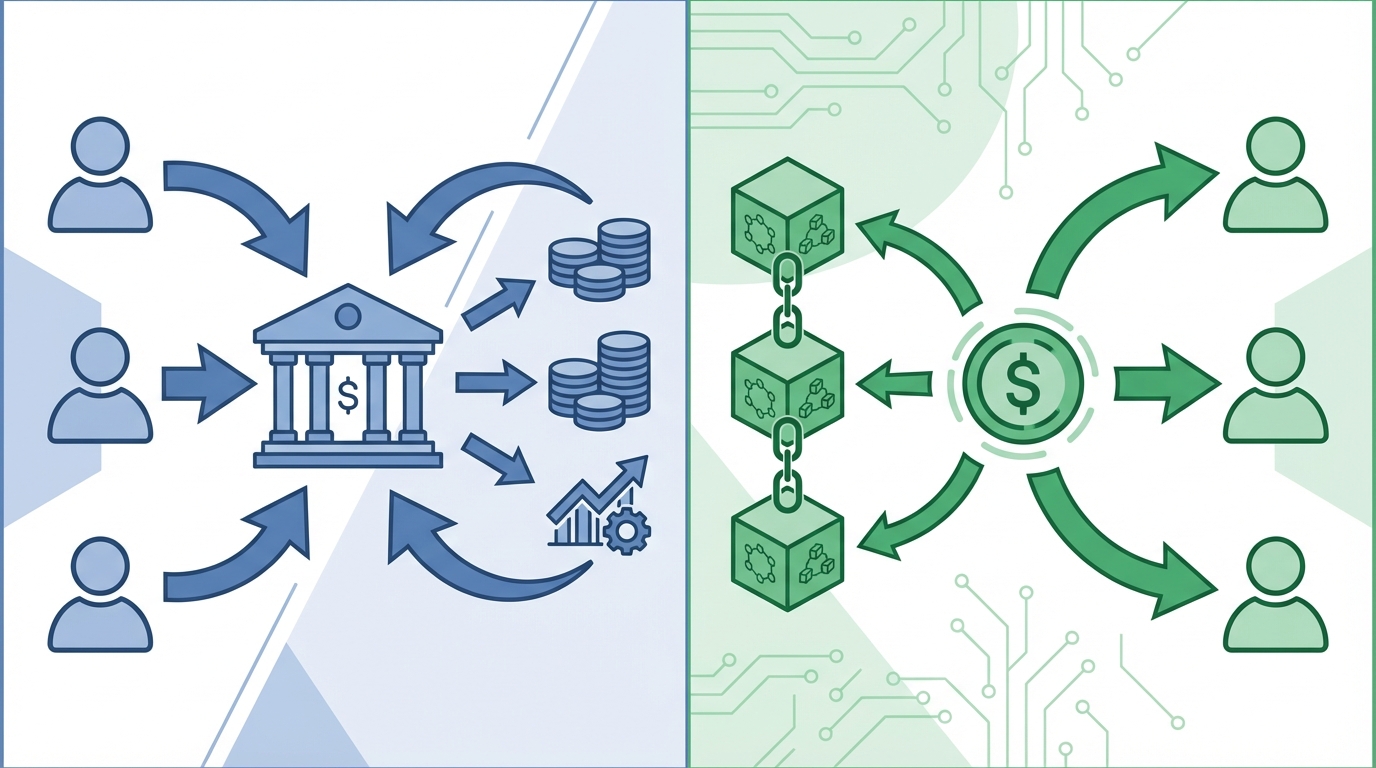

Stablecoin yield is no longer a niche promise; it is reshaping who captures returns on everyday balances. For decades, banks pooled consumer deposits, lent them, and kept most of the economic upside while offering safety and liquidity. However, yield-bearing stablecoins route rewards directly to token holders, and therefore they challenge that basic bargain. Because ordinary savers can now hold tokenized balances that earn passive yield by default, the incentive structure for banks, intermediaries, and regulators changes fast.

This shift matters to everyday depositors. If deposit-like balances start earning rewards outside the traditional banking system, consumers may see higher returns. At the same time, they may lose familiar protections such as FDIC insurance and regulated custody. Regulators will face trade-offs between promoting better returns and preserving safety, while banks will reconsider funding models. In short, the fight over stablecoin yield is a fight over deposits, access to returns, and systemic risk. This article analyzes the mechanics, the winners and losers, and the likely policy responses. Read on to understand practical implications for wallets, banks, and the broader market.

What is stablecoin yield?

Stablecoin yield describes the return that holders receive for keeping value in a stablecoin. In short, it is interest paid on a digital representation of value. Yield-bearing stablecoins pay rewards to token holders. As a result, balances can earn passive yield without traditional bank intermediation.

How yield-bearing stablecoins work

- Many stablecoins peg to fiat currency and live on blockchains. Because they sit on-chain, issuers can route rewards programmatically. For example, issuers may deposit reserves in short-term instruments, lending pools, or tokenized Treasuries. Then they share part of the returns with holders as yield. Consequently, holders receive periodic payments or higher redemption value.

- Some models wrap on-chain deposits that mirror bank claims. However, these digital claims may not carry FDIC insurance or supervised protections. Therefore, holders trade regulated safety for potential yields.

- Other models rely on decentralized protocols. These use automated market makers, liquidity mining, or interest-bearing vaults to generate returns. Because protocols run code, rewards depend on protocol risk and market conditions.

Why stablecoin yield matters

- First, it shifts who captures returns on deposits. Historically, banks earned most of that upside through lending and investment. Now token holders can claim part of it directly. This matters to everyday depositors seeking better returns.

- Second, it changes market plumbing. Tokenized cash, on-chain bank deposits, and tokenized Treasuries could all extend the trend.

- Third, it poses policy trade-offs. Regulators must weigh better consumer returns against safety and systemic risk. For context on deposit insurance and bank safety, see the FDIC resource and the Federal Reserve. For recent debate framing, see this analysis.

stablecoin yield and the challenge to traditional banking

The rise of stablecoin yield cuts at the core of traditional banking models. Banks historically gathered consumer deposits, lent them, and kept most returns. As a result, they funded loans and paid limited interest to depositors. However, yield-bearing stablecoins redirect some of that economic upside directly to holders. Therefore, banks face pressure on funding, margins, and the value of deposit relationships.

Key implications for banks and market structure

- FDIC insurance and safety trade-offs: Yield-bearing stablecoins often lack FDIC insurance. Consequently, depositors who chase yield may lose regulated protections. Regulators must decide whether to extend protections, as outlined in FDIC materials at FDIC Resources, or to leave tokenized balances outside the insured perimeter.

- Bank funding and liquidity: If customers shift funds into tokenized, yield-bearing balances, banks could see deposit outflows. For example, retail deposits are a low-cost funding source. Losing them raises funding costs and may force banks to rely more on wholesale markets. The Federal Reserve explains how funding and liquidity interact with monetary policy at Federal Reserve.

- Payments to depositors and market pricing: Stablecoins can automate rewards distribution. As a result, ordinary savers may gain passive yield without complex accounts. However, the price of that convenience may be exposure to protocol, custody, or credit risk.

- Market structure and intermediation: Yield-bearing stablecoins lower barriers for new intermediaries and protocols. Thus, nonbank entities can capture deposit-like flows. This change could fragment the payments and deposits landscape and alter who earns returns.

Practical examples and likely responses

- Banks may raise advertised rates or offer tokenized accounts to retain customers. At the same time, regulators will weigh systemic risk versus consumer benefits. For context on the debate framing, see this analysis at CoinDesk Analysis.

In short, stablecoin yield reshapes incentives. Policymakers and banks must adapt to protect consumers while preserving efficient funding. The coming years will show which model captures everyday balances.

| Type | Yield Source | Yield Accessibility | Risk Level | Regulatory Context |

|---|---|---|---|---|

| Traditional bank deposits | Bank lending and investments; returns captured via net interest margin | Interest-bearing accounts, CDs; access varies by product and bank | Low to moderate — FDIC insurance and supervision reduce depositor risk | Regulated banks; deposits generally covered by FDIC insurance and banking oversight |

| Yield-bearing stablecoins | Protocol revenues, lending pools, tokenized Treasuries, reserve investments | Programmatic on-chain distribution; widely accessible and instant for token holders | Higher — protocol, custody, counterparty, and market risk; no guaranteed insurance | Mostly unprotected or evolving rules; regulatory status varies and may lack deposit insurance |

Regulatory trade-offs and the future outlook for yield-bearing stablecoins

Yield-bearing stablecoins create policy choices that cut across consumer protection, financial stability, and market structure. Regulators must weigh the benefits of higher returns for depositors against the hazards of uninsured, on-chain balances. In addition, they must decide which intermediaries face supervision and who bears liability for losses.

Key regulatory challenges

- Consumer protection versus access to returns: Consumers may gain passive yield, but they often lose FDIC insurance and traditional safeguards. Therefore, regulators must consider whether to extend protections or require clearer disclosures. For background on deposit insurance, see the FDIC.

- Defining regulated intermediaries: Stablecoin ecosystems blur lines between issuers, custodians, and liquidity providers. As a result, regulators may need new categories of supervised intermediaries to manage counterparty and custody risk.

- Systemic risk and liquidity runs: Tokenized cash and on-chain bank deposits can enable fast redemptions. Consequently, a sudden outflow could create liquidity stress in both crypto and banking systems. Therefore, policymakers must design standing facilities or redemption backstops to contain runs.

- Cross-border fragmentation and crypto market structure legislation: Different jurisdictions take divergent approaches. For example, the EU’s Markets in Crypto-Assets framework sets detailed rules for stablecoin issuers. See the EU overview. Conversely, U.S. agencies continue to debate supervisory roles, as discussed by the Treasury.

Emerging regulatory approaches

- Narrow bank charters or sponsor rules: Some proposals would require stablecoin issuers to hold reserves at insured depository institutions. This approach preserves deposit protections while keeping stablecoin convertibility. For instance, U.S. policymakers have discussed variants that bind issuers to regulated banks.

- Transparency and reserve requirements: Regulators may mandate regular audits and high-quality reserves. Therefore, issuers would face capital-like constraints that reduce run risk.

- Intermediary licensing and custody standards: Another route is to license custodians and require strict custody rules. In this model, intermediaries must meet operational and capital standards.

Outlook and trade-offs

Regulation must balance innovation and safety. If regulators extend deposit-like protections too broadly, they risk encouraging moral hazard. However, strict exclusion could push activity into opaque corners. Therefore, a middle path may emerge. Policymakers will likely combine reserve standards, licensing, and targeted protections. As a result, stablecoin yield may persist, but under tighter guardrails. Ultimately, the regulatory choices will shape how returns on deposits flow and who captures them.

Conclusion

Stablecoin yield is forcing a rethink of who captures returns on deposit-like balances. In effect, yield-bearing stablecoins move rewards directly to holders instead of to banks. This change challenges the traditional bargain of safety, liquidity, and low rates.

For investors, the shift offers higher passive yield opportunities. However, they trade that yield for new risks, including custody failures, counterparty exposure, and protocol bugs. For regulators, the questions are hard and urgent. They must balance consumer protection with financial innovation. As a result, policy choices will determine whether yields remain a competitive feature or create new vulnerabilities.

For ordinary depositors, the choice will be between better returns and familiar protections. Consequently, banks may raise rates or offer tokenized products to retain balances. Therefore, market structure and intermediaries will evolve. In short, understanding stablecoin yield matters for portfolios, regulation, and everyday savers. Going forward, expect tighter rules, hybrid deposit products, and fresh contests over who earns deposit returns.