Bitcoin hashrate drops to seven-month low

Bitcoin hashrate has fallen to a seven-month low after a series of rapid declines, with the metric moving from roughly 1.2 zettahash per second (ZH/s) to about 950 exahashes per second (EH/s), a drop of roughly 20%. The decline included a plunge to roughly 663 EH/s by Sunday—a fall of more than 40% in two days—before a rebound to about 854 EH/s by Monday. The next difficulty adjustment is projected to decline by about 17%, and Bitcoin’s price is cited at around $88,000, versus a late-November low near $80,000 when the Hash Ribbon capitulation last occurred. Approximately 40% of global Bitcoin mining capacity went offline in the past 24 hours due to extreme winter weather, and the United States accounts for nearly 38% of global mining activity; at least 137 crypto-mining facilities nationwide were identified in a 2024 Energy Information Administration report. The reporting notes that mining operations can absorb excess electricity and power down during peak demand as a grid-stability mechanism, and KuCoin traded more than $1.25 trillion in 2025 volumes.

Recent Miner Capitulation and Bitcoin Price

The last recorded miner capitulation event, as identified by the Hash Ribbon metric, occurred in late November. During this period, Bitcoin reached a low price of approximately $80,000. In more recent developments, Bitcoin’s price is noted to be around $88,000. This price movement reflects some recovery since the last capitulation event, coinciding with fluctuations in Bitcoin’s hashrate and the broader crypto market activities.

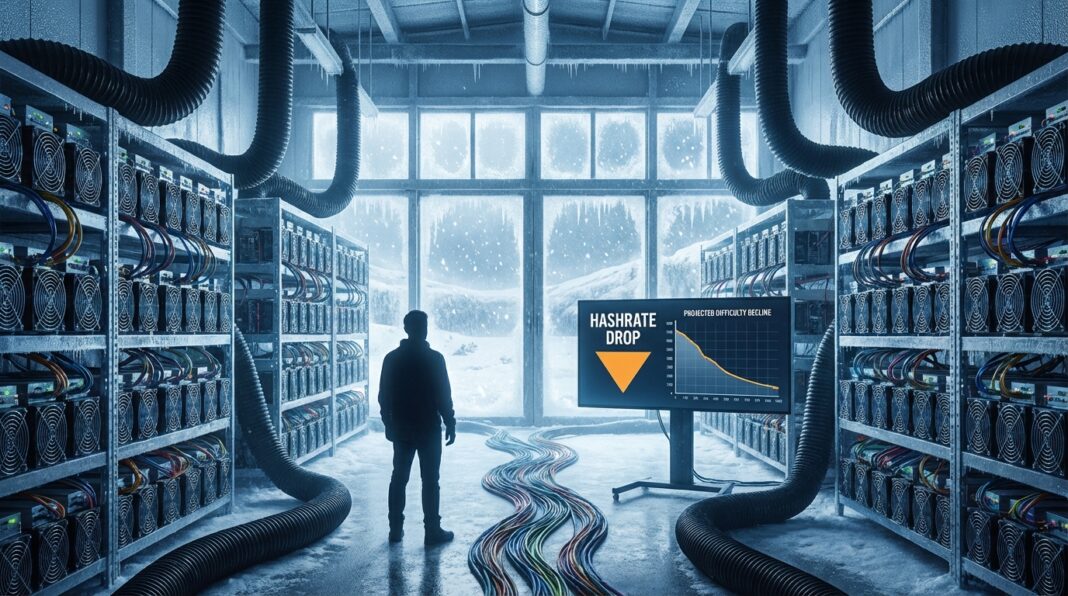

Recent Bitcoin Hashrate Fluctuations

The Bitcoin hashrate has recently experienced significant fluctuations, notably falling approximately 20% from around 1.2 zettahash per second (ZH/s) to 950 exahashes per second (EH/s). This sharp decline was marked by a brief plunge to approximately 663 EH/s by Sunday, a more than 40% drop within two days. Following this low, the hashrate rebounded to about 854 EH/s by Monday.

These fluctuations have prompted projections for the next difficulty adjustment, suggesting a decline of about 17%. The recent drop in the hashrate is partly attributed to extreme winter weather, which resulted in about 40% of global Bitcoin mining capacity going offline within a 24-hour period. Bitcoin’s network security remains robust, but these changes highlight the impact of environmental factors on mining operations.

Impact of Extreme Winter Weather on Bitcoin Mining

Extreme winter weather has significantly impacted global Bitcoin mining operations. Within a span of 24 hours, approximately 40% of global Bitcoin mining capacity was forced offline, highlighting the substantial effect of harsh climatic conditions on the industry. This situation contributed to a dramatic drop in the Bitcoin hashrate, which fell from around 1.2 zettahash per second (ZH/s) to the low of 663 exahashes per second (EH/s) by Sunday, marking a decline of more than 40% in just two days. The United States, which accounts for nearly 38% of the global Bitcoin mining activity, was particularly affected, with a significant portion of its mining capacity being shut down due to these weather conditions.

The US winter storm, alongside widespread adverse weather, has underscored vulnerabilities within the crypto mining sector, primarily its dependence on stable environmental and power conditions. Such events demonstrate the need for adaptive strategies in mining operations to mitigate these environmental risks effectively.

US Bitcoin mining activity and infrastructure

The United States accounts for nearly 38% of the global Bitcoin hashrate, reflecting the country’s large share of network mining power. A 2024 Energy Information Administration report identified at least 137 crypto-mining facilities nationwide, providing a baseline for the sector’s physical footprint. Mining operations are reported to have the capability to absorb excess electricity and to power down during peak demand as a grid-stability mechanism. These operational characteristics are cited alongside data on hashrate fluctuations and weather-related outages.

KuCoin 2025 trading volume

KuCoin traded more than $1.25 trillion in 2025 volumes. That figure is cited in the reporting as reflecting heavy exchange activity related to crypto markets. The volume number is presented alongside other factual points in the same reporting, which include recent hashrate fluctuations and mining capacity data.

Bitcoin hashrate recently fell roughly 20% from about 1.2 zettahash per second (ZH/s) to approximately 950 exahashes per second (EH/s), and included a brief plunge to roughly 663 EH/s by Sunday before a rebound to about 854 EH/s by Monday. The next difficulty adjustment is projected to decline by about 17%. Approximately 40% of global Bitcoin mining capacity went offline within a 24-hour period due to extreme winter weather, and the United States, which accounts for nearly 38% of global mining activity, was particularly affected.

A 2024 Energy Information Administration report identified at least 137 crypto-mining facilities nationwide, and the reporting notes that KuCoin traded more than $1.25 trillion in 2025 volumes.