Jeel and Ripple Blockchain Payments and Tokenization Partnership in Saudi Arabia

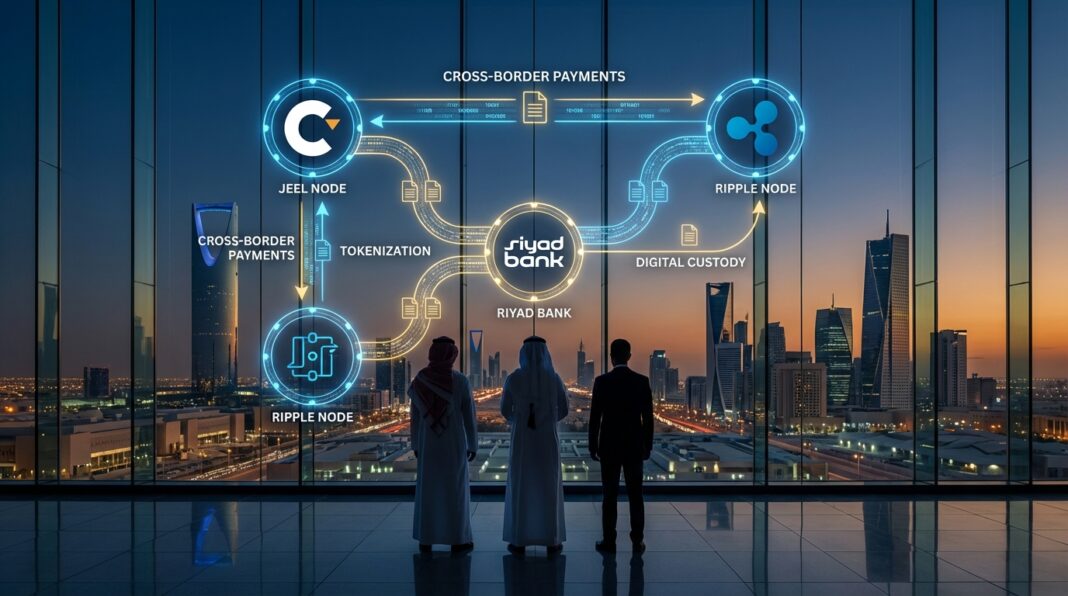

Jeel, a subsidiary of Riyad Bank, has signed a partnership with Ripple to explore advanced blockchain applications aimed at strengthening financial services across Saudi Arabia. The Jeel and Ripple blockchain payments and tokenization partnership in Saudi Arabia will focus on assessing use cases that could enhance cross-border payment speed, cost efficiency and transparency. Jeel will leverage its regulatory sandbox to conduct regulated experimentation and jointly develop proofs-of-concept with Ripple. This collaboration seeks to evaluate scalable and interoperable digital financial infrastructure in a controlled and compliant environment.

The partnership will focus on developing secure and transparent digital infrastructure to support the Middle East and examine digital asset custody and tokenization beyond payments. The sandbox approach is expected to help demonstrate solutions that could contribute to the modernization of Saudi Arabia’s banking ecosystem. Ripple gains strategic access to Saudi Arabia’s fintech landscape through Jeel’s institutional network and innovation platform. The announcement was shared with CryptoNews.

Partnership goals and technological focus

The partnership aims to develop secure and transparent digital infrastructure across the Middle East and to explore blockchain-based approaches that could improve the speed, cost efficiency and transparency of cross-border payments. In addition to payment rails, the collaboration will examine applications such as digital asset custody and tokenization as part of its technical scope. The parties intend to evaluate practical implementations that can be tested in controlled settings to determine operational viability and compliance alignment. The stated objectives include assessing scalable and interoperable digital financial infrastructure to support broader financial services modernization.

Cross-border payments are identified as a key area of opportunity for the Gulf region’s remittance and trade corridors, and the partnership’s technological focus is intended to target those corridors specifically. The initiative seeks to assess how distributed ledger technology can address frictions in international transfers relevant to regional remittance and trade flows. The collaboration is positioned to generate proofs-of-concept that test these use cases under regulated conditions to measure potential improvements in transactional efficiency and transparency.

Additional use cases and sandbox testing

The collaboration will extend beyond payments to examine digital asset custody and tokenization use cases. Jeel and Ripple will jointly develop proofs-of-concept within Jeel’s regulatory sandbox, the Jeel Sandbox, to test Ripple’s blockchain solutions under controlled and compliant conditions. Those proofs-of-concept are intended to evaluate technical and operational aspects of custody and tokenization workflows, including integration points with institutional infrastructure and compliance processes. The regulated testing environment will enable practical experimentation while maintaining oversight and alignment with applicable regulatory requirements.

Outputs from the sandbox work are expected to demonstrate scalable and interoperable digital financial infrastructure that could contribute to the modernization of Saudi Arabia’s banking ecosystem. The joint testing will seek to validate whether custody and tokenization implementations can operate alongside existing institutional networks and innovation platforms. The partnership structure provides Ripple access to local fintech channels through Jeel’s institutional network, enabling practical assessment of these non-payment blockchain applications within the national context.

Ripple gains strategic access to Saudi Arabia’s fintech landscape through Jeel’s institutional network and innovation platform. The partnership will focus on developing secure and transparent digital infrastructure to support the Middle East. Jeel and Ripple will jointly develop proofs-of-concept within Jeel’s regulatory sandbox to test Ripple’s blockchain solutions in a controlled and compliant environment. The sandbox approach is expected to help demonstrate scalable and interoperable digital financial infrastructure that could contribute to the modernization of Saudi Arabia’s banking ecosystem.

“This partnership with Ripple reflects our strategy of using the Jeel Sandbox to responsibly explore next-generation financial infrastructure,” said George Harrak CEO of Jeel. “By combining regulated experimentation with global blockchain expertise, we are building the foundations to evaluate scalable use cases that enhance cross-border payments and digital asset capabilities in line with the Kingdom’s long-term digital ambitions,” adds Harrak. “Saudi Arabia’s visionary leadership has established the Kingdom as a forward-thinking global hub for digital transformation,” said Reece Merrick, Managing Director for the Middle East and Africa at Ripple.

Jeel, a subsidiary of Riyad Bank, has formed a partnership with Ripple to advance blockchain payments and tokenization in Saudi Arabia through collaborative technical and regulatory work.

The partnership is focused on developing secure and transparent digital infrastructure across the Middle East and on assessing how blockchain technology can improve the speed, cost efficiency and transparency of cross-border payments.

Jeel and Ripple will jointly develop proofs-of-concept within Jeel’s regulatory sandbox to test Ripple’s blockchain solutions in a controlled and compliant environment.

These sandboxed efforts are expected to demonstrate scalable and interoperable digital financial infrastructure and to contribute to the modernization of Saudi Arabia’s banking ecosystem while aligning with the Kingdom’s long-term digital ambitions.